1120 S Form 2020 - 217) to complete schedule d (form 1120) and form 4797, sales of business property, obtain. Income tax return for an. This form is used to report the income, gains, losses, deductions, credits, and other relevant. Income tax return for an s. This guidance is meant for s. Income tax return for an s corporation, including recent.

This guidance is meant for s. Income tax return for an. This form is used to report the income, gains, losses, deductions, credits, and other relevant. Income tax return for an s. Income tax return for an s corporation, including recent. 217) to complete schedule d (form 1120) and form 4797, sales of business property, obtain.

This form is used to report the income, gains, losses, deductions, credits, and other relevant. Income tax return for an s. This guidance is meant for s. Income tax return for an s corporation, including recent. 217) to complete schedule d (form 1120) and form 4797, sales of business property, obtain. Income tax return for an.

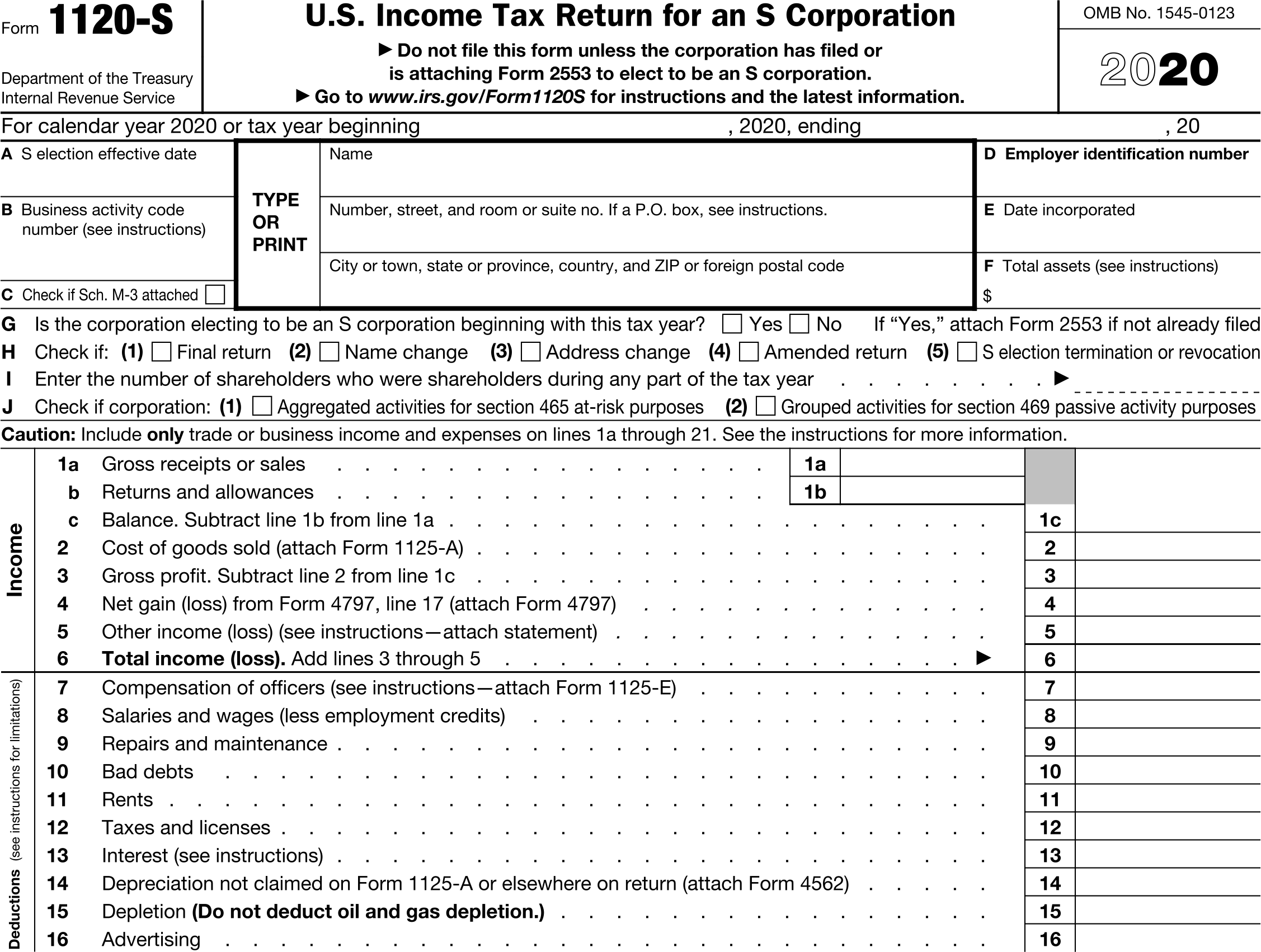

Form 1120S U.S. Tax Return for an S Corporation

This guidance is meant for s. Income tax return for an s. Income tax return for an s corporation, including recent. This form is used to report the income, gains, losses, deductions, credits, and other relevant. Income tax return for an.

Form 1120s 2023 Printable Forms Free Online

217) to complete schedule d (form 1120) and form 4797, sales of business property, obtain. Income tax return for an s corporation, including recent. Income tax return for an. This form is used to report the income, gains, losses, deductions, credits, and other relevant. This guidance is meant for s.

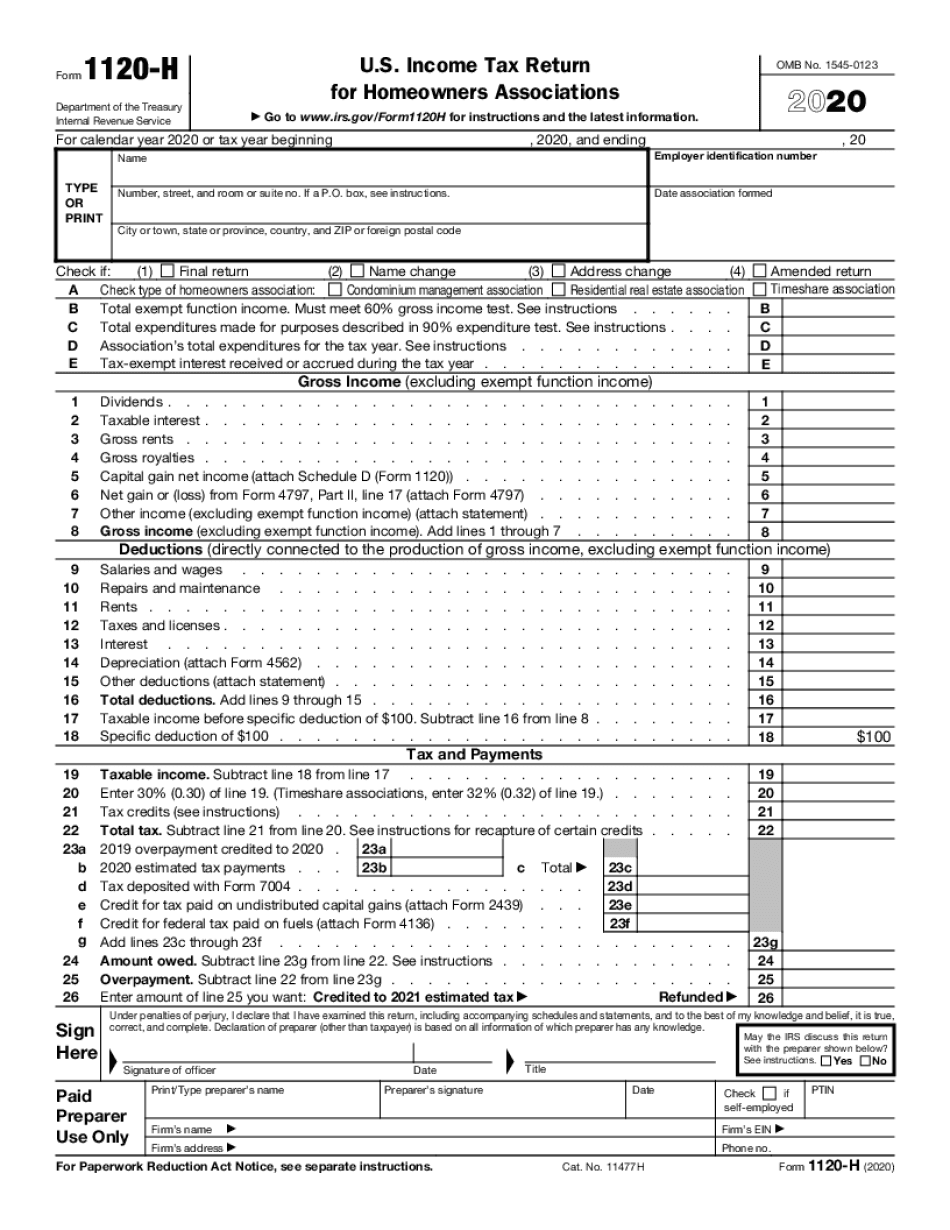

IRS Form 1120 (2020) U.S. Corporation Tax Return

217) to complete schedule d (form 1120) and form 4797, sales of business property, obtain. Income tax return for an s corporation, including recent. Income tax return for an. Income tax return for an s. This guidance is meant for s.

1120 Tax Form Blank Sample to Fill out Online in PDF

This guidance is meant for s. This form is used to report the income, gains, losses, deductions, credits, and other relevant. Income tax return for an s corporation, including recent. Income tax return for an s. 217) to complete schedule d (form 1120) and form 4797, sales of business property, obtain.

1120s 2014 Form Form Resume Examples goVLr409va

Income tax return for an. This guidance is meant for s. Income tax return for an s corporation, including recent. 217) to complete schedule d (form 1120) and form 4797, sales of business property, obtain. Income tax return for an s.

Form 1120s Fillable Printable Forms Free Online

This form is used to report the income, gains, losses, deductions, credits, and other relevant. Income tax return for an s corporation, including recent. Income tax return for an. This guidance is meant for s. Income tax return for an s.

Form 1120S S Corporation Tax Return Fill Out Online PDF FormSwift

This form is used to report the income, gains, losses, deductions, credits, and other relevant. Income tax return for an s. Income tax return for an. Income tax return for an s corporation, including recent. This guidance is meant for s.

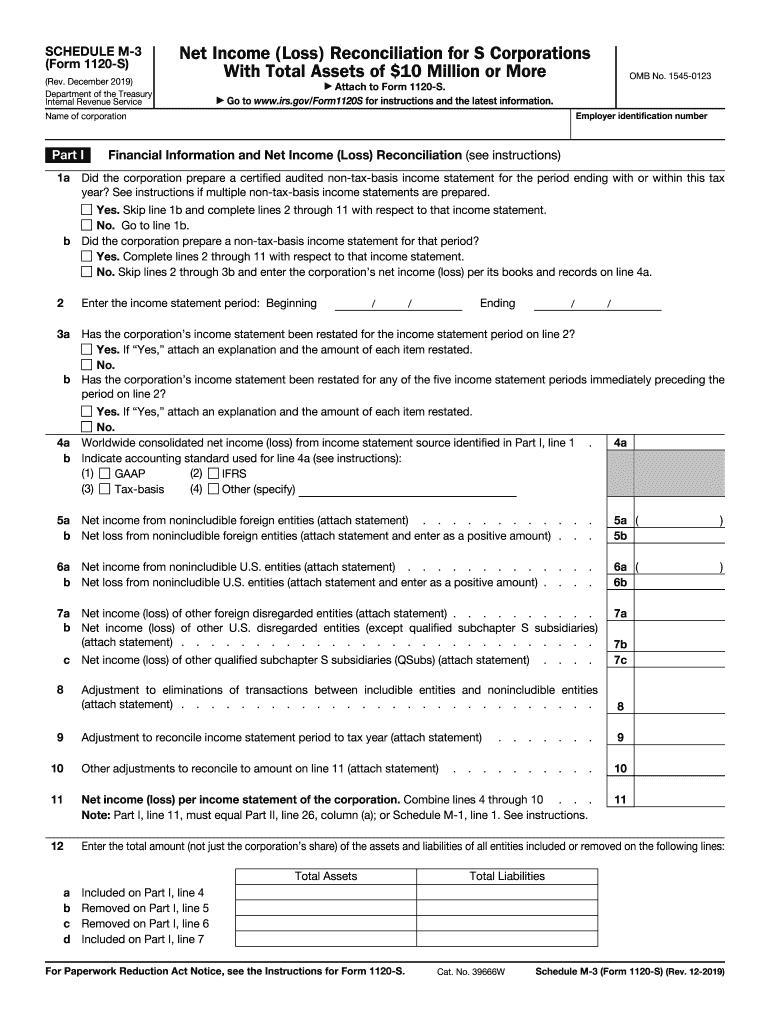

All About Form 1120S for S Corporation Tax Filing

217) to complete schedule d (form 1120) and form 4797, sales of business property, obtain. Income tax return for an s corporation, including recent. Income tax return for an s. This guidance is meant for s. This form is used to report the income, gains, losses, deductions, credits, and other relevant.

IRS Form 1120S (2020) U.S. Tax Return for an S Corporation

Income tax return for an s. 217) to complete schedule d (form 1120) and form 4797, sales of business property, obtain. Income tax return for an s corporation, including recent. This form is used to report the income, gains, losses, deductions, credits, and other relevant. Income tax return for an.

Income Tax Return For An S.

This guidance is meant for s. 217) to complete schedule d (form 1120) and form 4797, sales of business property, obtain. This form is used to report the income, gains, losses, deductions, credits, and other relevant. Income tax return for an s corporation, including recent.