Does Prepaid Rent Go On The Balance Sheet - In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. When a company prepays for an expense, it is recognized as a prepaid asset on the balance sheet, with a simultaneous entry being. There can be several different examples of prepaid expenses commonly found on the company’s balance sheet. These are both asset accounts and do not increase or. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash.

Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. These are both asset accounts and do not increase or. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. When a company prepays for an expense, it is recognized as a prepaid asset on the balance sheet, with a simultaneous entry being. There can be several different examples of prepaid expenses commonly found on the company’s balance sheet.

These are both asset accounts and do not increase or. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. When a company prepays for an expense, it is recognized as a prepaid asset on the balance sheet, with a simultaneous entry being. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. There can be several different examples of prepaid expenses commonly found on the company’s balance sheet.

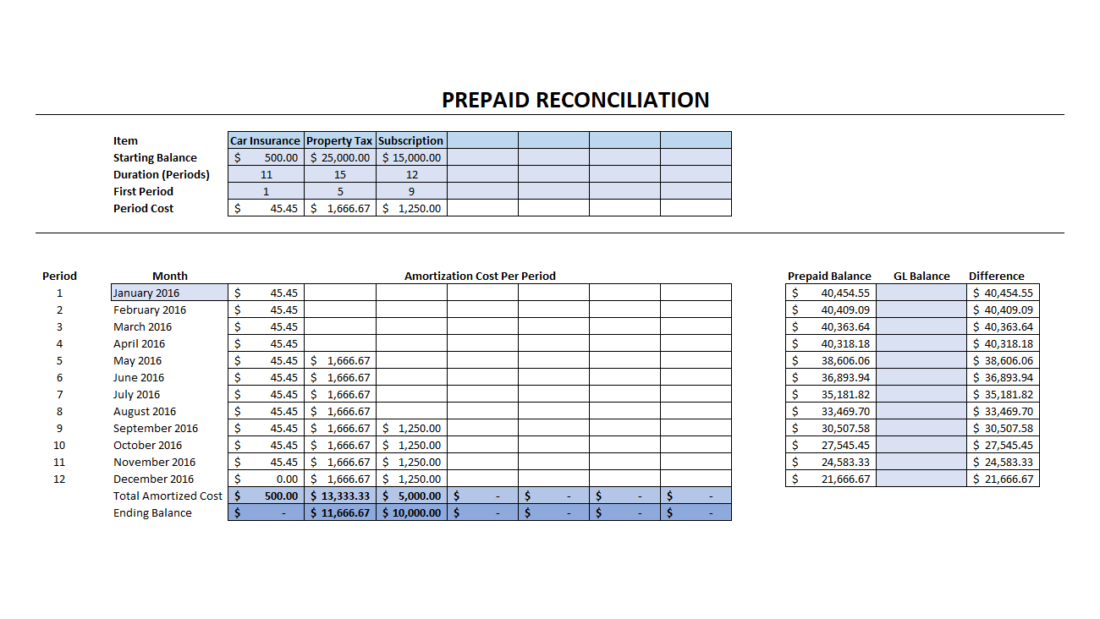

Where are prepaid expenses on balance sheet? Leia aqui Are prepaid

In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. These are both asset accounts and do not increase or. There can be several different examples of prepaid expenses.

Prepaid Expenses on Balance Sheet Quant RL

In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. When a company prepays for an expense, it is recognized as a prepaid asset on the balance.

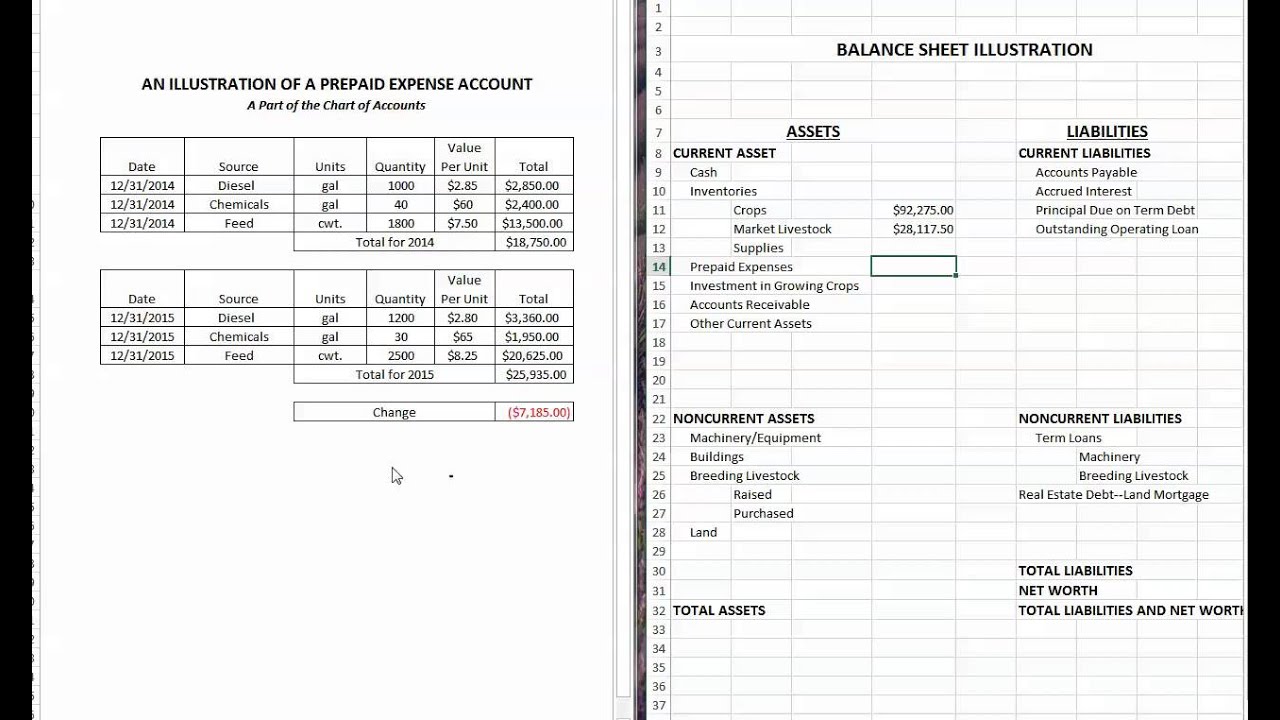

Prepaid Expenses In Balance Sheet Analysis Template Ipsas 20 Financial

Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. When a company prepays for an expense, it is recognized as a prepaid asset on the balance sheet, with a simultaneous entry being. There can be several different examples of prepaid expenses commonly found on the company’s balance sheet. The.

Prepaid Expenses Balance Sheet Ppt Powerpoint Presentation Infographics

When a company prepays for an expense, it is recognized as a prepaid asset on the balance sheet, with a simultaneous entry being. These are both asset accounts and do not increase or. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. There can be several different examples of.

Prepaid expenses balance sheet bezywave

In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. These are both asset accounts and do not increase or. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. When a company prepays for an expense,.

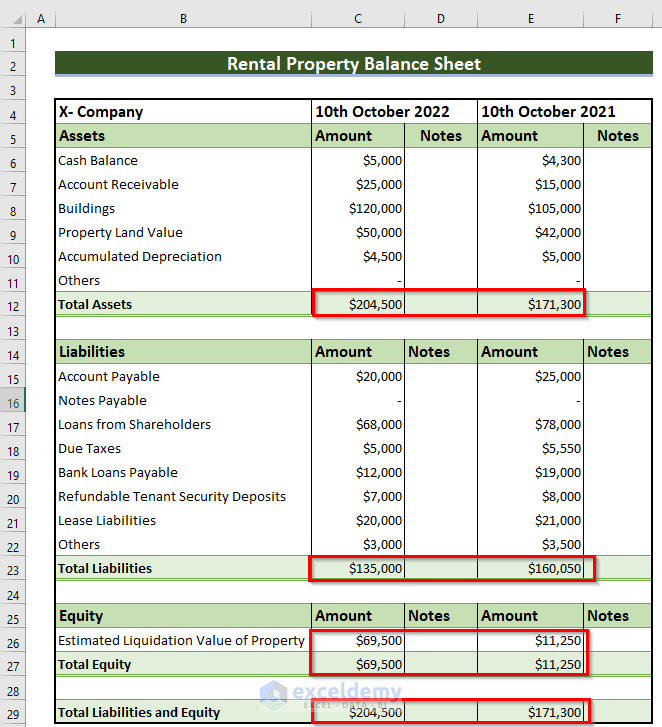

Rental Property Balance Sheet in Excel 2 Methods (Free Template)

These are both asset accounts and do not increase or. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. The initial journal entry for prepaid rent.

Prepaid Expenses In Statement And Balance Sheet Template South

Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. When a company prepays for an expense, it is recognized as a prepaid asset on the balance sheet, with a simultaneous entry being. These are both asset accounts and do not increase or. The initial journal entry for prepaid rent.

Where is prepaid expenses on balance sheet? Leia aqui Where do prepaid

When a company prepays for an expense, it is recognized as a prepaid asset on the balance sheet, with a simultaneous entry being. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. These are both asset accounts and do not increase or. The initial journal entry for prepaid rent.

Where Is Prepaid Rent On The Balance Sheet LiveWell

These are both asset accounts and do not increase or. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. There can be several different examples of prepaid expenses commonly found on.

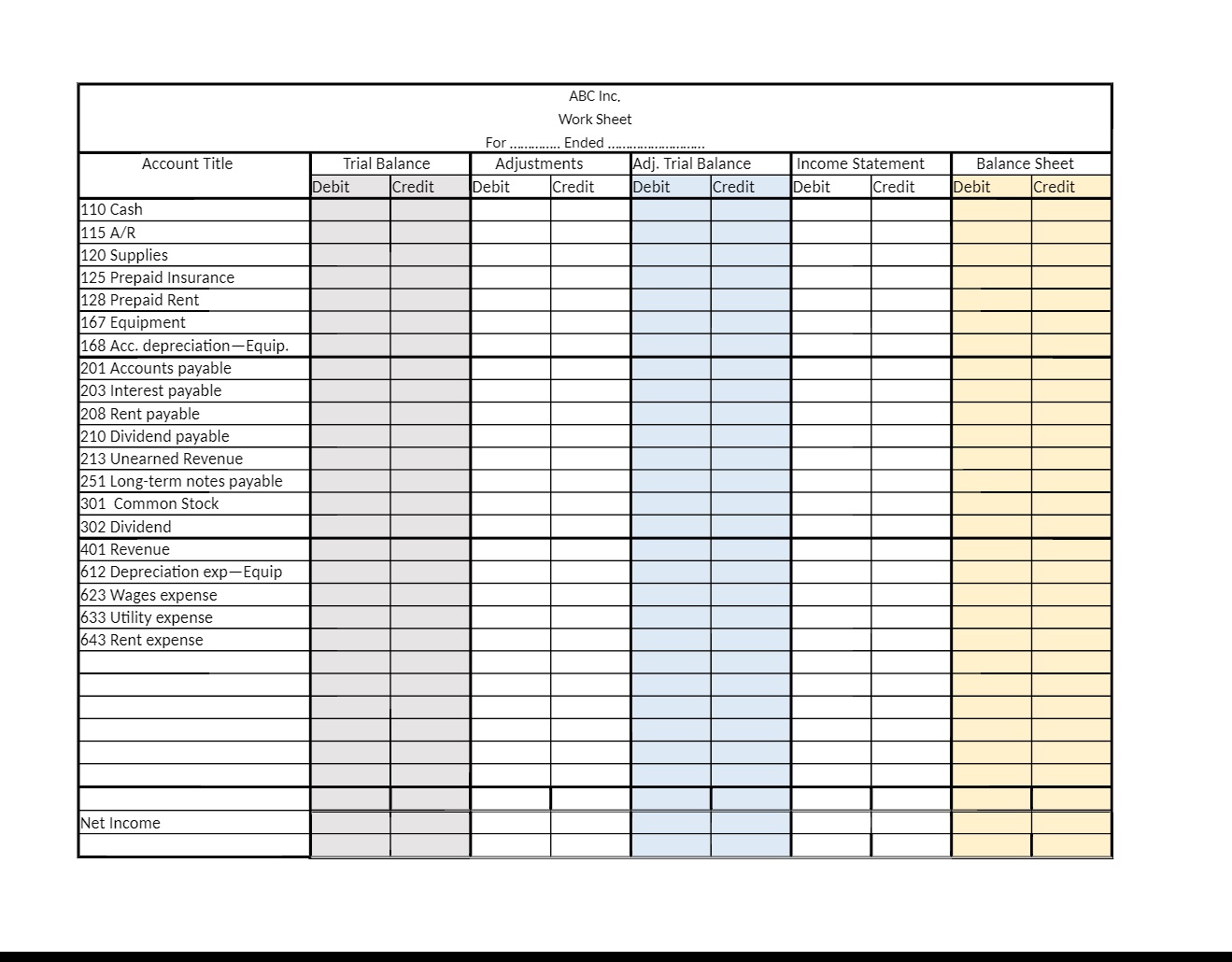

Help, cant balance sheet, see prepaid insurance and accumulated

The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. When a company prepays for an expense, it is recognized as a prepaid asset on the balance sheet, with a simultaneous entry.

In Short, Store A Prepaid Rent Payment On The Balance Sheet As An Asset Until The Month When The Company Is Actually Using.

The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. These are both asset accounts and do not increase or. There can be several different examples of prepaid expenses commonly found on the company’s balance sheet. When a company prepays for an expense, it is recognized as a prepaid asset on the balance sheet, with a simultaneous entry being.

:max_bytes(150000):strip_icc()/prepaid-expense-4191042-recirc-blue-1d8d154bf0c94ba6858fe12907d2b694.jpg)